Colombia’s Inflation Rate Surpasses Expectations at 5.28% for February

Colombia’s inflation rate reached 5.28% in February, higher than expected, with a monthly rise of 1.14%. January’s rate was 5.22%. Analysts revised upward their inflation predictions for 2025. Education, transport, and housing costs spurred inflation, while the central bank held interest rates steady amid ongoing inflation concerns.

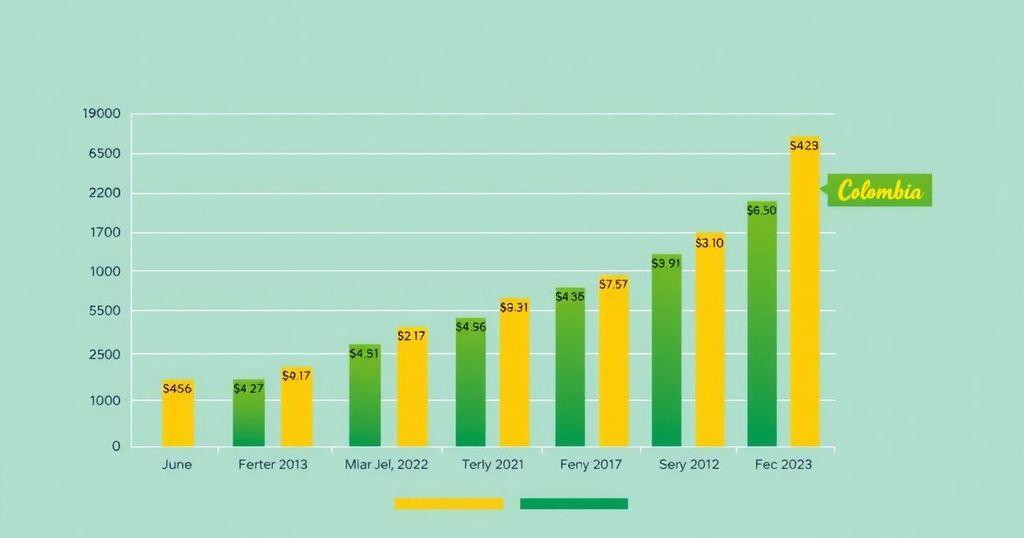

In February, Colombia’s consumer price index increased by 1.14%, resulting in a 12-month inflation rate of 5.28%, as reported by the national statistics agency DANE. This figure surpassed analysts’ expectations, who had anticipated a monthly rise of just 1% and an annual inflation rate of 5.13%. The annual inflation rate has risen slightly from the previous month’s figure of 5.22%, remaining significantly above the central bank’s long-term target of 3%. Moreover, January’s monthly inflation increase was recorded at 0.94%.

Analysts have recently adjusted their inflation forecasts, now predicting an end-of-year inflation rate of 4.22% for 2025, up from the earlier estimate of 4%. Contributing to February’s inflation were significant increases in education, transport, and housing costs, especially post-back-to-school season. Conversely, the information and communication sector demonstrated a decline in monthly costs.

In light of current inflation expectations, Colombia’s central bank opted to maintain its benchmark interest rate steady in January, marking the first time in over a year that no rate cut was implemented, contrary to market expectations. February’s consumer prices showed notable changes, detailed as follows:

– February: Monthly change +1.14%, Accumulated 12 months +5.28%

– January: Monthly change +0.94%, Accumulated 12 months +5.22%

– Food and non-alcoholic beverages: February +0.60%, January +1.62%

– Housing and public services: February +1.16%, January +0.39%.

In summary, Colombia’s inflation rate has risen to 5.28% for the 12 months ending February, surpassing analysts’ predictions. Factors influencing this increase include significant hikes in education, transport, and housing costs. Furthermore, adjustments in inflation forecasts indicate persistent upward pressure on prices, prompting the central bank to maintain interest rates accordingly, all while remaining above the targeted inflation threshold.

Original Source: www.tradingview.com

Post Comment