Climate change

AFRICA, ANGOLA, ASCOR, ASSESSING SOVEREIGN CLIMATE - RELATED OPPORTUNITIES AND RISKS PROJECT, BLOOMBERG, CLIMATE CHANGE, CLIMATE JUSTICE, COSTA RICA, DONALD TRUMP, ENERGY DEPARTMENT, ENVIRONMENTAL POLICY, EUROPE, GREENHOUSE GAS EMISSIONS, NORTH AMERICA, PARIS AGREEMENT, RENEWABLE ENERGY, UNITED STATES, US, VICTORIA BARRON

Isaac Bennett

0 Comments

Wealthy Nations Struggle to Achieve Climate Commitments, ASCOR Study Concludes

Wealthy countries are falling short in meeting climate goals according to the ASCOR study, with investors observing insufficient action towards emissions reduction commitments. The urgency of climate action is heightened by projections of rising global temperatures and a burgeoning legal landscape targeting climate inaction. Although some countries are advancing, systemic issues like inadequate climate financing and reliance on fossil fuels persist.

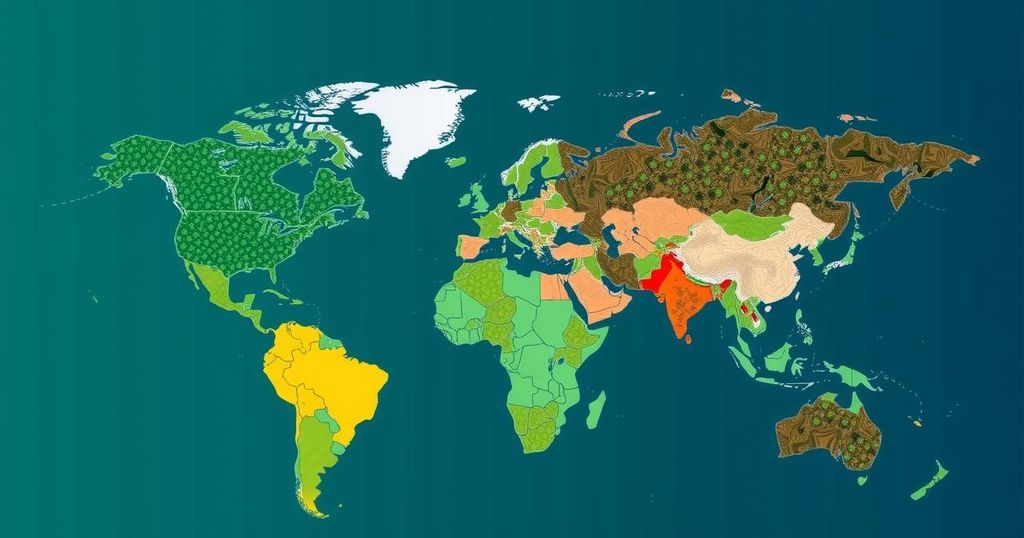

A recent study, the Assessing Sovereign Climate-related Opportunities and Risks Project (ASCOR), highlights significant shortcomings among wealthy nations in addressing climate change, particularly in comparison to the global target of limiting temperature rise to 1.5 degrees Celsius. The analysis of 70 countries reveals that wealthy nations’ commitments to reducing emissions by 2030 are insufficient and lack the necessary momentum. Concerns about climate change have prompted investors in government bonds to scrutinize the environmental policies of these nations. The urgency of the situation is underscored by forecasts indicating that 2024 could emerge as the hottest year on record, with rising temperatures already reaching alarming levels.

Victoria Barron, Chief Sustainability Officer at GIB Asset Management and co-chair of ASCOR, emphasized the need for credible government action: “Investors need to see more credible action by governments. Investors play a pivotal role in driving capital, and these flows require robust and tangible national climate and energy policies.” However, the financial markets are reportedly not fully accounting for the potential risks posed by climate change. Researchers are examining an emerging concept known as the “climate-sovereign debt doom loop,” which gauges how climate impacts might exacerbate national debt burdens.

Currently, nations are facing legal implications for their perceived failures to protect citizens from extreme climate events, with the International Court of Justice set to hold hearings. In the United States, developments point to a potential withdrawal from the Paris Agreement following the election of a new President. Meanwhile, in Europe, corporate resistance is challenging the commitment of policymakers to sustainability goals.

Nonetheless, some nations are making strides in climate action. Countries such as Costa Rica and Angola are nearing compliance with the 1.5C benchmarks, while alarming statistics show that less than 20% of the global nations intend to cease the endorsement of new fossil fuel projects. Furthermore, over 80% of wealthy nations fail to meet their financial obligations towards a $100 billion international climate finance target, which is projected to rise to $300 billion at the forthcoming COP29 summit. On a positive note, ASCOR now encompasses a broader assessment of climate strategies, comprising 70 countries instead of the original 25. Notably, 40 countries have developed legal frameworks to tackle climate-related challenges, and three-quarters possess plans for managing physical climate risks.

The urgency of addressing climate change has garnered increased attention among investors, particularly in government bonds. This concern is magnified as current temperatures threaten to breach critical thresholds established by international climate agreements, such as those set forth in the Paris Agreement. The ASCOR study offers a comprehensive analysis of how wealthier nations are performing against their climate commitments, ensuring alignment with global ambitions numerous countries are failing to meet. This analysis coincides with heightened legal scrutiny towards nations that inadequately protect their citizens from environmental hazards, inviting deeper investigation into the financial ramifications of neglecting climate initiatives.

The ASCOR study elucidates a troubling trend among wealthy nations failing to adequately respond to climate change challenges, leaving investors and governments alike at a crossroads. The findings reveal a stark lack of progress toward achieving the necessary emission reductions required to stabilize global temperatures within safe limits. As climate-related risks intensify, urgent action is needed to align national policies with global climate targets, with particular attention to the financial obligations of wealthy countries. While some nations display promise in their climate strategies, overall commitment remains critically deficient, necessitating a reevaluation of approaches to climate finance and sustainable development.

Original Source: www.outlookbusiness.com

Post Comment