Climate change

AFRICA, ASIA, AZERBAIJAN, BAKU, CLIMATE, CLIMATE CHANGE, DISASTER RELIEF, EX, EXXONMOBIL, GREENPEACE INTERNATIONAL, JAPAN, MEXICO, NATURAL DISASTERS, NORTH AMERICA, OECD, PARIS AGREEMENT, PHILIPPINES, SENEGAL, SHELL, STAMP OUT POVERTY, UN, UN FUND FOR RESPONDING TO LOSS AND, USA

Isaac Bennett

0 Comments

Accountability for Climate Loss and Damage: The Case for a Climate Damages Tax

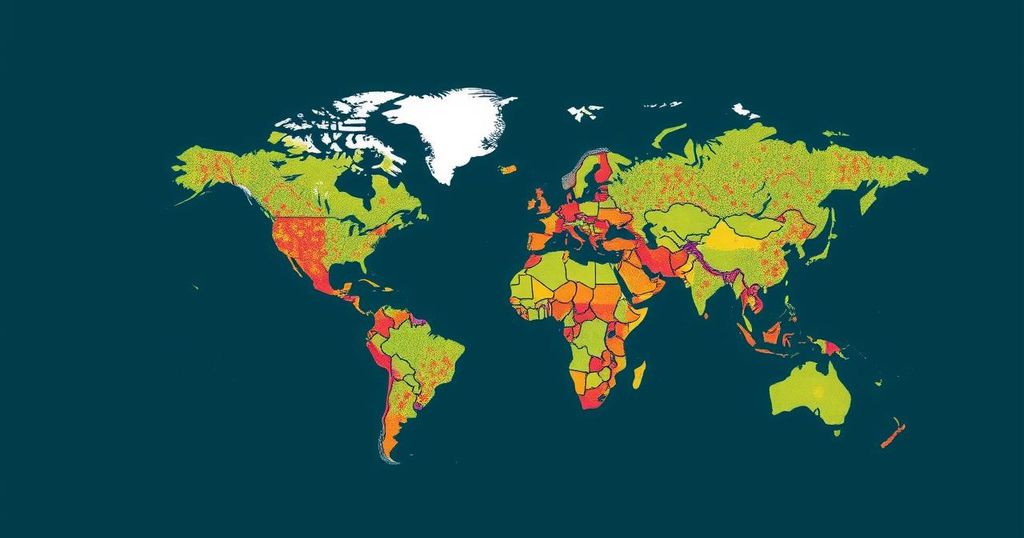

At COP29 in Baku, there is a push for a Climate Damages Tax (CDT) on major oil companies to fund recovery efforts for communities affected by climate change. Research indicates that such a tax could raise significant resources—potentially over $900 billion by 2030. This strategy aims to shift the burden of climate crisis remediation from victims to polluters, underscoring themes of climate justice and accountability.

At the recent UN climate change conference in Baku (COP29), discussions intensified regarding a new climate financial package to address the ongoing climate crisis, particularly focusing on loss and damage. There is a recognized consensus that vulnerable communities worldwide are disproportionately affected by climate-related events. A proposed Climate Damages Tax (CDT) on major oil and gas companies could potentially raise significant funds to aid affected areas, with analyses by Greenpeace International and Stamp Out Poverty indicating that a modest tax could increase the UN Fund for Responding to Loss and Damage by over 2000%.

Taxation of top oil firms based on their last year’s revenues could have immediate implications, such as covering damages from severe weather events resulting from climate change. For instance, taxation of ExxonMobil’s 2023 extraction could finance half of the costs associated with Hurricane Beryl, while Shell and TotalEnergies could cover losses from significant typhoons and floods in other regions. Given the nearly $150 billion that Big Oil earned last year, a consistent tax policy could provide approximately $900 billion by 2030, facilitating climate action and enhancing financial support for communities enduring the repercussions of climate emergencies.

This issue transcends financial calculations; it fundamentally relates to climate justice, calling for a shift in accountability from the victims of climate crises to the contributors. As evidenced by escalating climate disasters, innovative funding mechanisms, including a climate damages tax, are urgently needed. Furthermore, recent protests witnessed affected individuals and Greenpeace activists uniting to demand accountability from oil companies, showcasing poignant reminders of climate impacts through symbolic gestures involving personal belongings lost to climate events.

Abdoulaye Diallo, Co-Head of Greenpeace International’s Stop Drilling Start Paying project, emphasized the necessity for governments to enforce measures compelling climate polluters to prioritize reparations over profit. In summary, a united voice advocating for accountability is essential if we are to ensure that those responsible for exacerbating the climate crisis contribute to corrective measures that support affected communities.

The topic of climate loss and damage has emerged prominently within global climate discussions, particularly at forums like COP29. As evidence mounts regarding the impacts of climate change, vulnerable communities are increasingly facing dire consequences. Governments are now grappling with how to finance climate responses effectively. The narrative revolves around not only the acknowledgment of the harm inflicted by climate change but also the responsibility of major fossil fuel companies in perpetuating these crises. A proposal has gained traction for a Climate Damages Tax (CDT) that would levy taxes on oil and gas companies, potentially raising substantial funds to mitigate climate damages and support rebuilding efforts in affected communities. This endeavor requires identifying a fair mechanism that shifts the financial burden of climate impacts from the victims to the corporations profiting from fossil fuels.

In conclusion, the discussions stemming from COP29 underscore a crucial turning point in the fight against climate change, emphasizing accountability and financial justice. The advocacy for a Climate Damages Tax is not merely a fiscal strategy; it reflects a moral imperative to hold those responsible for environmental degradation accountable for the harm they cause. By mobilizing resources from wealthy oil and gas companies, a framework can be established to support those facing the harsh realities of climate impacts. The need for collective action and advocacy remains paramount to instigate necessary change.

Original Source: www.ipsnews.net

Post Comment