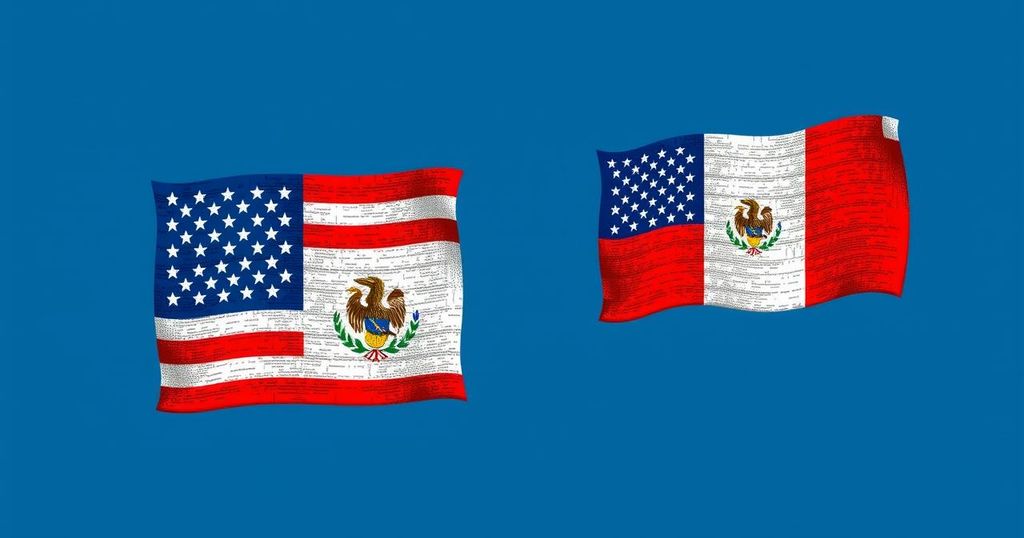

New US-Chile Tax Treaty Enhances Certainty for Multinational Enterprises

The US-Chile income tax treaty, effective December 19, 2023, enables multinational enterprises to utilize mutual agreement procedures and advance pricing agreements to mitigate double taxation. As Chile’s audit activities increase, this treaty represents a significant step in enhancing tax certainty for MNEs. It marks the second US bilateral tax treaty with a South American country and the first in over ten years.

On December 19, 2023, the income tax treaty between the United States and Chile officially took effect. This agreement enables multinational enterprises (MNEs) to utilize US-Chile mutual agreement procedures (MAPs) and bilateral advance pricing agreements (APAs), which are essential tools for mitigating the risks of double taxation and enhancing tax certainty. In light of the anticipated increase in audit activities within Chile, this treaty is a significant development for MNEs seeking stability and predictability in their tax obligations. Notably, this treaty marks the second comprehensive bilateral tax treaty enacted by the United States with a South American nation and is the first such agreement to come into force in over a decade.

The US-Chile income tax treaty is a significant legal framework enhancing cross-border tax relations between the two countries. With the growing presence of multinational enterprises in Chile and the corresponding increase in its tax audit activities, the treaty serves to provide essential legal assurances against double taxation. This is particularly important for MNEs engaged in international trade and investment, allowing them greater financial planning capability. The treaty’s implementation is a reflection of a broader effort by the United States to strengthen its economic ties in Latin America.

In summary, the US-Chile income tax treaty, effective December 19, 2023, provides a vital mechanism for MNEs to lessen the burden of double taxation through mutual agreement procedures and advance pricing agreements. This treaty is not only a reinforcement of the bilateral relations between the United States and Chile but also a strategic tool for MNEs amid increasing scrutiny in Chile’s tax environment. Such treaties are crucial for informing MNEs’ compliance strategies and promoting investment between nations.

Original Source: news.bloombergtax.com

Post Comment