Nigeria Eurobond Yields Increase Amid Foreign Investor Asset Trim

Nigeria’s Eurobond yields are rising as foreign portfolio investors reduce holdings amid a bearish sentiment. The Central Bank of Nigeria has kept key rates unchanged to maintain stability, even as economic indicators show vulnerabilities. Global shifts and disappointing job data are influencing investor sentiment negatively, leading to increased yields on Nigerian Eurobonds.

Recent trends indicate a decline in Nigeria’s sovereign Eurobond holdings as foreign portfolio investors (FPIs) adopt a risk-off sentiment. Portfolio managers are reassessing developments in Nigeria, perceiving increased risks in relation to broader global market trends.

During its February meeting, the Central Bank of Nigeria (CBN) decided to maintain the Monetary Policy Rate (MPR) and other key financial parameters. The CBN’s decision reflects a cautious approach aimed at preventing disruptions in market stability while allowing the impact of earlier rate hikes to permeate the economy, as noted by Erad Partners Limited.

In the U.S., economic indicators have shown concerning signs under President Trump’s administration, which has adopted a protective stance in policy making. On Wednesday, Eurobond market activity saw continued profit-taking by investors looking to reduce their holdings, although this was conducted at a controlled pace.

Initially optimistic about potential tariff relief, the Eurobond market’s sentiments shifted negatively due to falling oil prices and a disappointing private-sector jobs report. The ADP report indicated a mere addition of 77,000 jobs in February, significantly below projections and highlighting economic vulnerabilities.

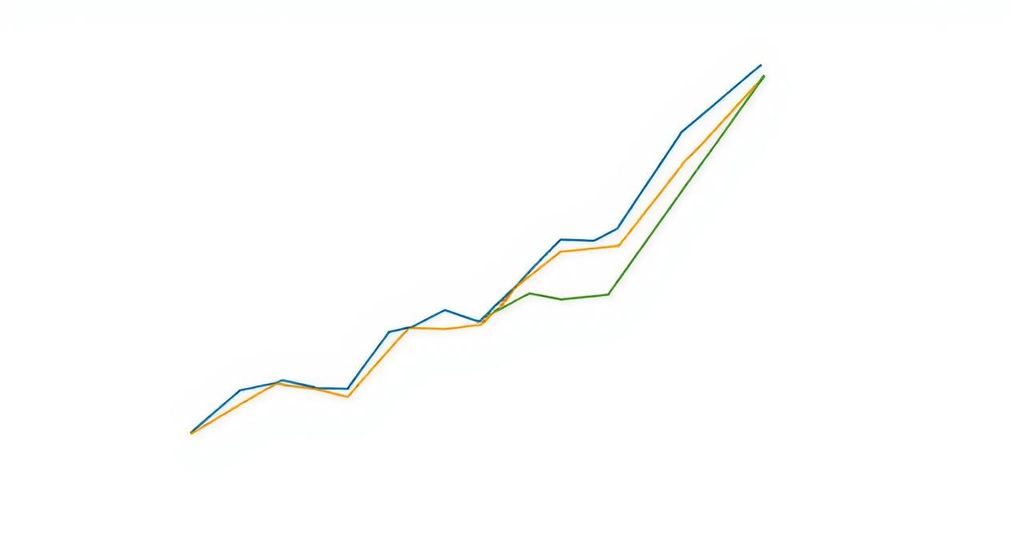

Consequently, the average mid-yield for Nigerian Eurobonds climbed by 5 basis points to 9.02%, with the greatest selling pressure on shorter maturities, notably the November 2025 bond which increased by 4 basis points. Analysts predict continued negative sentiment unless favorable developments arise.

February witnessed significant shifts in the global fixed-income market influenced by changes in monetary policies, geopolitical tensions, and growth anxieties, according to CardinalStone Partners Limited. It emphasized that bond yields decreased across significant economies, tracking the trends in U.S. Treasury bonds which saw the 10-year yield decline to its lowest since early December 2024.

Initially, market focus had centered around the inflationary consequences of Trump’s tariffs, establishing expectations for persistently high interest rates. The economic outlook began to change in February as investors reacted to waning economic data leading to a systematic de-risking of their portfolios. Notably, the February ISM manufacturing survey indicated an unexpected contraction, foretelling possible economic slowdowns.

In summary, foreign portfolio investors are divesting from Nigeria’s Eurobonds amid a bearish sentiment prompted by global economic concerns and disappointing domestic data. The Central Bank of Nigeria’s decision to maintain financial rates is geared towards sustaining market stability. However, ongoing international economic challenges and domestic vulnerabilities present obstacles, suggesting that the negative sentiment may endure unless favorable developments occur.

Original Source: dmarketforces.com

Post Comment