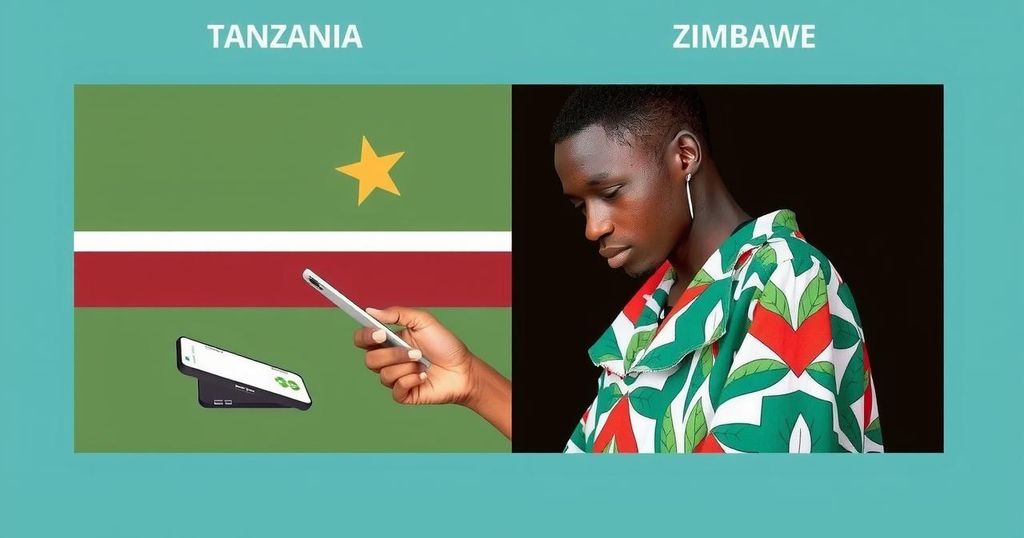

Contrasting Approaches to Digital Payments: Tanzania vs. Zimbabwe

Tanzania has ended card payment charges to boost digital transactions, contrasting with Zimbabwe’s 2% tax that hampers them. While Zimbabwe once reached 70% in electronic payments, the IMTT tax led to a decline. This discussion emphasizes the significant impact of government policies on cashless payment adoption.

The ongoing discourse surrounding digital payment systems has revealed stark contrasts between Tanzania and Zimbabwe’s approaches. Tanzania, for instance, has recently eliminated charges on card payments in an ambitious move to foster a cash-lite economy, enhancing ease of transaction for its citizens. In stark opposition, Zimbabwe’s implementation of a 2% tax on integrated money transfers serves as a deterrent, effectively discouraging digital transactions.

Historically, Zimbabwe had witnessed a commendable surge in electronic payments, reaching 70% in 2017. This transition swiftly reversed with the imposition of the Integrated Money Transfer Tax (IMTT) in 2018, as the government aimed to capitalize on burgeoning electronic transactions. This tax spurred a significant regression towards cash transactions. The current trend in Zimbabwe underscores a broader issue: despite attempts from the government to promote digital payments, the financial burden imposed by taxes has made alternatives more appealing to users.

Meanwhile, Tanzania is proactively pursuing a digital future. The initiative spearheaded by the Bank of Tanzania seeks to foster digital payment adoption by eliminating charges for card payments at point-of-sale terminals. This initiative aligns with Tanzania’s strategic economic growth vision aimed at enhancing security, transparency, and transactional convenience.

The disparity between these two nations highlights the necessity for Zimbabwe to reconsider its approach to digital transactions. The potential scrapping of the charges in Zimbabwe could initiate a transformative shift. However, questions arise regarding the financial viability of banks that depend heavily on transaction fees and how the government would manage revenue loss from the IMTT. With these considerations, it appears that Zimbabwe’s digital transaction prospects remain hindered.

The history of monetary policies in Zimbabwe illustrates the significant impact that fiscal measures can have on the adoption of cashless solutions. Barring any substantial changes to the current financial framework, the nation may continue to face challenges in transitioning towards a more digital economy, echoing the cautionary tale of past attempts that have been undone by governmental greed.

The backdrop of this discussion pivots on the contrasting approaches to digital payments in Tanzania and Zimbabwe. While Tanzania is enthusiastically promoting electronic payments and has removed fees to encourage their use, Zimbabwe is grappling with a counterproductive tax policy that deters the very adoption of such technologies. This comparison sheds light on the broader implications of government policies on economic behaviors and transaction preferences. Furthermore, Zimbabwe’s previous attempts to integrate digital payments have been stymied by taxing mechanisms that disincentivize innovation and ease of access to financial services.

In conclusion, the divergent paths taken by Tanzania and Zimbabwe in the realm of digital payments highlight the crucial role government policies play in shaping economic landscapes. Tanzania’s proactive elimination of card payment charges may serve as a catalyst for its digital economy, while Zimbabwe’s fiscal constraints are likely to perpetuate reliance on cash transactions. Without significant reforms, Zimbabwe may struggle to leverage the advantages of digital financial systems, which could stifle economic growth opportunities.

Original Source: www.techzim.co.zw

Post Comment