Exploring the Impact of Climate Shocks on Economic Resilience in Zambia

The UNU WIDER Working Paper 2024/71 investigates the effects of climate shocks on firm performance and tax revenues in Zambia. The study finds that extreme weather events lead to reduced sales and tax collections, particularly affecting sectors like manufacturing and construction. Firms respond by lowering employment and wages, indicating decreased productivity. This research highlights the importance of understanding climate change impacts on economics in low-income contexts, especially regarding tax reliance on firm performance.

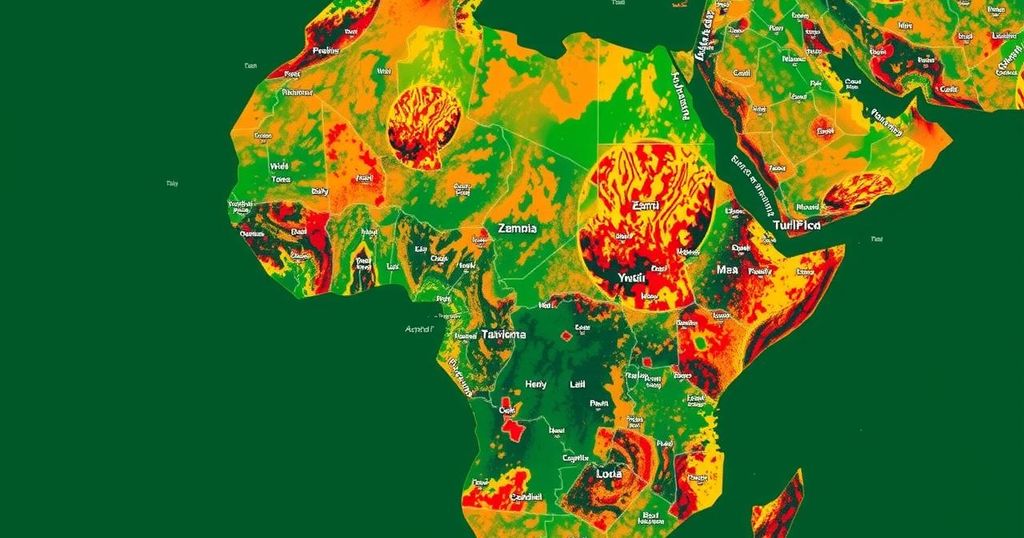

The paper “Climate Shocks and Economic Resilience: Evidence from Zambia’s Formal Sector” by Kwabena Adu-Ababio, Evaristo Mwale, and Rodrigo Oliveira presents a rigorous exploration of how climate-induced shocks affect firm performance and tax revenue in Zambia. The research utilizes firm-level data to analyze the repercussions of extreme weather events, such as excessive rainfall and high temperatures, particularly within critical sectors like manufacturing, retail, accommodation, and construction. The analysis reveals that these climate events lead to a decrease in sales, input procurement, and overall tax collection, prompting firms to lower employment and wages as a consequence of diminished productivity. This highlights the crucial interplay between climate shocks, firm productivity, and fiscal health in low-income countries where tax revenues heavily rely on the performance of various sectors.

Overall, the findings underscore the urgency for policymakers in developing nations to incorporate strategies that address the dual challenges of climate change and economic resilience, aiming to bolster both firm productivity and tax revenue. An inclusive approach must recognize that the stability of the formal sector is vital for sustaining government revenues derived from taxation on goods and services, particularly through value-added tax (VAT), which constitutes a significant portion of government budgets.

Climate change poses a significant threat to low-income countries, particularly as they face compounded challenges in mobilizing domestic revenue. The intersection of climate shocks and economic resilience is a topic that has seldom been explored in depth, particularly regarding its impact on formal sector firms and government tax revenues. Zambia serves as a pertinent case study due to its vulnerability to extreme weather patterns and the reliance of its economy on various sectors that are susceptible to these disruptions. Understanding how climate shocks affect productivity and tax collection can inform better policy decisions aimed at fostering economic stability in the region.

In conclusion, the research highlights the negative effects of climate shocks on firm performance and tax revenue in Zambia. It advocates for a systematic approach to understanding the interdependencies between climate resilience and economic productivity. Policymakers must develop strategies that can mitigate the adverse impacts of climate events on both the formal economy and government financing, especially in contexts where taxation plays a critical role in funding public services and infrastructure.

Original Source: reliefweb.int

Post Comment